Basel Ii Risk Categories . conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. basel ii mandates the maintenance of bank capital to address three broad categories of risk: Credit risk, market risk and operation. deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: the basel committee on banking supervision issued for public comment guidelines for computing capital for. this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%, 50% and. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international.

from www.slideshare.net

this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%, 50% and. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. basel ii mandates the maintenance of bank capital to address three broad categories of risk: deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. Credit risk, market risk and operation. the basel committee on banking supervision issued for public comment guidelines for computing capital for. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international.

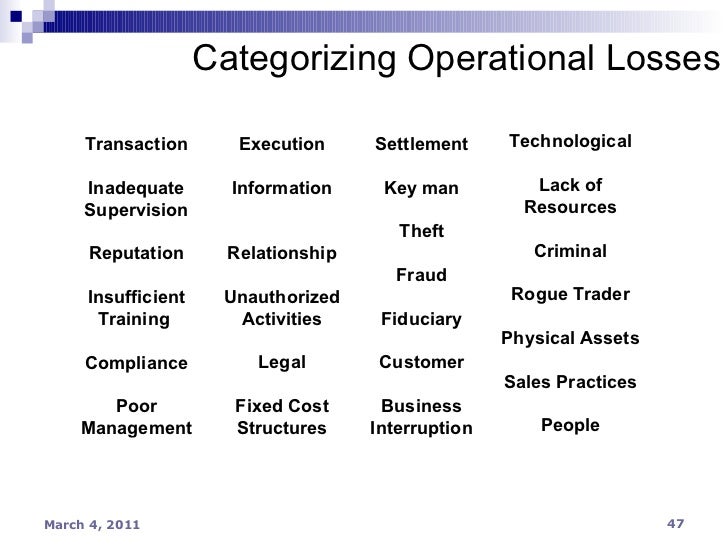

Operational Risk & Basel Ii

Basel Ii Risk Categories conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. Credit risk, market risk and operation. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%, 50% and. conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. the basel committee on banking supervision issued for public comment guidelines for computing capital for. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: basel ii mandates the maintenance of bank capital to address three broad categories of risk: deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are.

From en.ppt-online.org

Operational Risk Management Best Practice Overview and Implementation Basel Ii Risk Categories conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. basel ii mandates the maintenance of bank capital to address three broad categories of risk: it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: this article explains the seven categories of risks that. Basel Ii Risk Categories.

From www.slideserve.com

PPT Operational Risk Management PowerPoint Presentation, free Basel Ii Risk Categories deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. basel ii mandates the maintenance of bank capital to address three broad categories of risk: this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. Credit risk, market risk and operation.. Basel Ii Risk Categories.

From www.slideshare.net

Operational Risk & Basel Ii Basel Ii Risk Categories the basel committee on banking supervision issued for public comment guidelines for computing capital for. deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: conduct and legal risks ( including risks associated with money laundering. Basel Ii Risk Categories.

From www.slideserve.com

PPT Operational Risk Management PowerPoint Presentation, free Basel Ii Risk Categories conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%,. Basel Ii Risk Categories.

From www.slideserve.com

PPT Operational Risk and the Basel II Capital Accord PowerPoint Basel Ii Risk Categories the basel committee on banking supervision issued for public comment guidelines for computing capital for. this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%, 50% and. basel ii mandates the maintenance of bank capital to address three broad categories of risk: Credit risk, market risk and operation.. Basel Ii Risk Categories.

From www.slideserve.com

PPT Training PowerPoint Presentation ID4104639 Basel Ii Risk Categories basel ii mandates the maintenance of bank capital to address three broad categories of risk: it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. the basel committee on banking. Basel Ii Risk Categories.

From en.ppt-online.org

Capital adequacy Basel 2. Financial institutions management kimep Basel Ii Risk Categories this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. Credit risk, market risk and operation. basel ii mandates the maintenance of bank capital to address three broad categories of risk: this categorisation is applied to measure default risk, with assets being ranked in four risk. Basel Ii Risk Categories.

From www.sia-partners.com

Economic Capital in the light of Basel II 2nd pillar requirements Basel Ii Risk Categories Credit risk, market risk and operation. deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. basel ii mandates the maintenance of bank capital to address three broad categories of risk:. Basel Ii Risk Categories.

From www.slideshare.net

Operational Risk & Basel Ii Basel Ii Risk Categories basel ii mandates the maintenance of bank capital to address three broad categories of risk: deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. the basel committee on banking supervision issued for public comment guidelines for computing capital for. Credit risk, market risk and operation. this categorisation is applied to. Basel Ii Risk Categories.

From www.scribd.com

BaselIIFramework.pdf Risk Evaluation Basel Ii Risk Categories basel ii mandates the maintenance of bank capital to address three broad categories of risk: conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: this article explains the seven categories of risks that. Basel Ii Risk Categories.

From www.scribd.com

Risk Management Under Basel IISession 1 Basel Ii Operational Risk Basel Ii Risk Categories conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. basel ii mandates the maintenance of bank capital to address three broad categories of risk: Credit risk, market risk and operation. deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. this article explains. Basel Ii Risk Categories.

From www.slideshare.net

Operational Risk & Basel Ii Basel Ii Risk Categories deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. the basel committee on banking supervision issued for public comment guidelines for computing capital for. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. this categorisation is applied to. Basel Ii Risk Categories.

From www.slideshare.net

Operational Risk & Basel Ii Basel Ii Risk Categories Credit risk, market risk and operation. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: basel ii mandates the maintenance of bank capital to address three broad categories of risk: deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. this article explains the seven. Basel Ii Risk Categories.

From www.slideshare.net

Operational Risk & Basel Ii Basel Ii Risk Categories basel ii mandates the maintenance of bank capital to address three broad categories of risk: this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international. conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. this categorisation is. Basel Ii Risk Categories.

From www.researchgate.net

Basel II risk weights and credit assessments Download Scientific Diagram Basel Ii Risk Categories the basel committee on banking supervision issued for public comment guidelines for computing capital for. this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%, 50% and. this article explains the seven categories of risks that have been propounded in the basel norms by the bank of international.. Basel Ii Risk Categories.

From www.slideshare.net

Achieving HighPerforming, SimulationBased Operational Risk Measurem… Basel Ii Risk Categories the basel committee on banking supervision issued for public comment guidelines for computing capital for. Credit risk, market risk and operation. it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. this categorisation is. Basel Ii Risk Categories.

From www.researchgate.net

Risk weight table for bank exposures in the Basel II framework under Basel Ii Risk Categories deregulation and globalisation of financial services, together with the growing sophistication of financial technology, are. the basel committee on banking supervision issued for public comment guidelines for computing capital for. basel ii mandates the maintenance of bank capital to address three broad categories of risk: this article explains the seven categories of risks that have been. Basel Ii Risk Categories.

From www.slideshare.net

Operational Risk & Basel Ii Basel Ii Risk Categories it has set out 3 approaches of increasing sophistication to assessing the operational risk charge: this categorisation is applied to measure default risk, with assets being ranked in four risk weight buckets (0%, 20%, 50% and. conduct and legal risks ( including risks associated with money laundering or terrorist financing) remain important concerns. the basel committee. Basel Ii Risk Categories.